You need to use a private loan to realize a great deal of various objectives! No matter if you want to repay higher-fascination financial debt, finance a house advancement project, produce a extensive-awaited acquire, or something else completely, a private loan may help you ensure it is take place.

Totally! You can normally regulate your payment date in the dashboard. Understand that if you extend your billing period by every day or even more, you might fork out supplemental interest over the life of your respective loan.

Very best credit score cardsBest reward supply credit score cardsBest harmony transfer credit score cardsBest vacation credit rating cardsBest cash back credit score cardsBest 0% APR credit history cardsBest rewards credit score cardsBest airline credit score cardsBest higher education pupil credit score cardsBest charge cards for groceries

Significant Information and facts & Frequently Questioned Concerns Why opt for a private Loan? Particular loans give flexibility that other types of loans like car loans and home loan loans usually do not present, as it can be used for a range of explanations. Private loans are repaid over a set time frame and infrequently times carry a fixed curiosity price. The moment approved by a lender, you'll acquire your loan amount up entrance, and be needed to pay the a reimbursement with desire in typical regular monthly payments to the lender. Are there Applicable Service fees? FastLoanDirect products and services are delivered totally free for you. Nevertheless, the lender you will be connected with will typically demand you applicable service fees and/or interest according to the lender and also the loan settlement. Regardless of the situation, before you decide to indication any loan agreement, the lender should supply you with total disclosure in the conditions of your loan arrangement so you can also make the choice that is definitely good for you. Make sure you note that it's important to examine through the terms from the settlement before signing. What's “Annual Proportion Fee” – APR? The Once-a-year Share Charge (APR) would be the once-a-year charge charged for borrowing which is expressed to be a proportion that represents the actual yearly cost of funds over the term from the loan. As loans can vary regarding interest-level framework, transaction costs, late penalties and also other things, a standardized computation like the APR delivers borrowers using a base-line amount they can certainly Look at to premiums charged by other lenders. Due to the fact FastLoanDirect doesn't provide loans by itself, it's important to Call the lender that you are linked with on to obtain the specific particulars of the loan settlement. How can I repay my loan? The private loans supplied by lenders within our community Have a very 91-working day minimum amount repayment as well as a 72-thirty day period most repayment term. Just about every lender has got to explicitly explain the loan to the loan settlement, hence we recommend that prior to accepting any loan, you go through the loan arrangement , Primarily the parts that include specific information about APR and repayment phrases. Imagine if I am late on payments? Each and every lender has distinctive late payment penalties and guidelines. In most cases, if you are late on a payment, a lender may perhaps demand you that has a late penalty. Consequently, it can be crucial to established on your own a reminder in order that problems with late payment or non-payment usually do not occur. Mainly because non-payment and late payment penalties vary by lender, you should contact the lender you might be connected with specifically Should you have any issues or concerns repaying your loan. The amount Funds Will You Qualify For After you Ask for Your own Loan On the web? Click Start out Now to connect using a lender which can help you. Get rolling Now Agent Case in point In case you borrowed $one,five hundred about a 18 month period of time and the loan had a 3% origination fee ($45), your month-to-month repayments could well be $a hundred.

Variable prices can go up and down based on distinctive market situations which may lead to increased-than-envisioned fascination charges, particularly in turbulent economic times when desire charges may fluctuate.

Kim Lowe is really a lead assigning editor on NerdWallet's loans staff. She addresses consumer borrowing, which include topics like individual loans, purchase now, shell out later on and cash progress applications. She joined NerdWallet in 2016 following 15 several years at MSN.com, wherever she held a variety of content roles such as editor-in-chief of your overall health and foods sections.

Remember to remember that lacking a payment or earning a late payment can negatively effect your credit history score. To guard you along with your credit history record, you should definitely only acknowledge loan terms you can afford to pay for to repay.

After authorised by a lender, your funds are deposited straight into your account as soon as another business working day.

Delicate inquiries or credit history pulls, on the other hand, tend not to appear on your credit report and have no impact on your credit history score. Examples of situations which will require a delicate inquiry involve lenders pulling your credit rating to ascertain your eligibility for pre-approved presents, probable companies doing a track record check, or landlords checking read more your credit history any time you apply for an condominium.

Should you’re looking for cash to pay for expenses, to pay health care charges Or even auto repairs. 79Cash has the lenders you're looking for.

Homeownership guideManaging a mortgageRefinancing and equityHome improvementHome valueHome coverage

Nesmetaju, LLC seems to be an Energetic entity in the loan servicing business and is related with the next loan matching networks:

Cash advance apps like EarnIn, Dave and Brigit Allow you to borrow a small quantity from the upcoming paycheck ahead of you receive it. This quick take care of could aid if you need cash in an emergency, but it really’s intelligent to take into consideration more cost-effective solutions before you decide to borrow via a cash progress app.

Acquire now, spend afterwards: “Obtain now, fork out later” apps like Affirm and Afterpay split a big obtain, like a mattress or notebook, into scaled-down payments. The most typical structure may be the pay-in-four prepare, where you pay twenty five% on the expense upfront and afterwards make 3 far more biweekly payments.

Mr. T Then & Now!

Mr. T Then & Now! Rick Moranis Then & Now!

Rick Moranis Then & Now! Tia Carrere Then & Now!

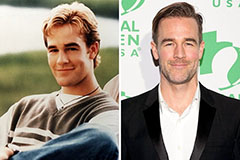

Tia Carrere Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!